Automated trading a.k.a. algorithmic trading (algo trading) utilizes sophisticated computer programs to place trades. The algorithmic trading systems are based on a predefined set of rules, allowing for rapid-pace trading activity which cannot be matched by a human trader. This meritorious trading paradigm eliminates emotionally-based trading errors, and focuses on rules-based systems. Algo-trading is activated by a set of rules which determines how financial instruments will be traded – bought or sold – on behalf of an investor/trader. Once conditions have been met, buy/sell orders are placed.

These robo advisors (algorithmically-based trading bots) automatically monitor market activity, including trends, patterns, price points, et al for a wide range of financial instruments at the same time. While human traders can perform similar actions for a limited number of financial instruments, algo-trading is capable of monitoring scores of assets 24/7. As such, algorithmically-based trading activity has many inherent benefits. These include the dramatically reduced possibility of error, much lower transactions costs, execution of trades at the best possible prices, real-time management of a portfolio of assets, and precise timing of trading activity to eliminate the possibility of substantial price movements.

How do Robo-advisors work?

A robo-advisor is an automated trading platform. Traders and investors are required to complete a brief survey detailing their retirement objectives and risk tolerance (risk averse or risk seeking). Armed with this information, a robo advisor can put together the ideal investment portfolio based on your needs. By eliminating the high fees, commissions, and management costs associated with face-to-face human advisors, a robo advisor simply manages all activity on behalf of the client at a much lower cost, with no emotional component whatsoever. The merits of such a trading system are clear: lower costs and greater objectivity in all investment-related services that are offered.

The prominence of algo-trading systems has increased dramatically in recent years. Clients are recognizing the benefits of these proven systems, which also allow for flexibility from the investor’s perspective. Ideal for small, medium, and large-scale investments, robo advisors are associated with low fees and low risk. By reducing the costs of using a broker, or fund manager, investors have lower fees to contend with and more money to invest in their portfolios. Provided the right robo advisor has been selected, this can lead to greater returns and more valuable portfolios. Naturally, the right robo advisor is one which is affordably priced and a proven performer.

Increasing popularity of Robo Advice

Charles Schwab published a report titled: The Rise of Robo: Americans Perspectives and Predictions on the Use of Digital Advice. The report found that an increasing number of investors expect robo advisors to play a much more important part in the investment arena. By improving the price and the process of investment activity, robo advisors are naturally invaluable resources to clients. According to the report, some 58% of Americans anticipate using the services by 2025 and 45% of Americans believe that robo advice will have the biggest impact on the financial services sector.

Additionally, 80% of millennials prefer a robo advisor with human access possibilities, and 71% of all surveyed people want an advisor with access to human advice. Equally important is the fact that some 46% of baby boomers believe that robo advice is really important for their life stage and 45% of them anticipate using robo advisors by 2025. Of all the people using robo advisors, 60% are millennials and almost 25% are Generation X’ers. This comprehensive study factored in independent research from human intelligence from some 1,000 respondents and 391 robo advisor users 18+ years of age between July 25-31, 2018. The study’s margin of error was +/-3.1%, with a 95% confidence level.

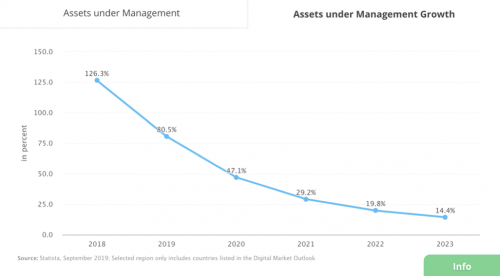

Source: Statista Robo Advisor Total Assets Under Management

According to Statista, the increasing prevalence of robo-advisors is part of a much broader global trend. In 2017, the assets under management with robo advisors was valued at $240,025 million, growing to $543,188 million in 2018, and $980,541 million in 2019. Projected assets under management in million USD $ in 2020, 2021, 2022, 2023 are listed as follows:

2020 – $1,442,028 million

2021 – $1,863,438 million

2022 – $2,231,721 million

2023 – $2,552,265 million

It is worth pointing out that the year-on-year growth with assets under management in 2019 was 80.5%, and the number of users for 2019 was reported at 45,773.9 (thousand) with 75.4% year-on-year growth. In terms of assets under management in 2019, the robo-advisor segment measured 80.5% growth over 2018, and is expected to show 47.1% growth in 2020. By 2021, that figure is expected to grow by 29.2%, 19.8 % in 2022, and by 14.4% in 2023.

Source: Statista Robo Advisor Assets Under Management Growth

Many other important trends are evident from the in-depth statistical analysis and research conducted by leading financial and investment companies. For example, the number of users (robo-advisor penetration rate) is expected to climb sharply in 2020 to 70,508.6 (thousand), and 97,397.7 (thousand) in 2021, 123,538.6 (thousand) in 2022, and 147,018.4 (thousand) in 2023. Robo advisory services have gained widespread appeal, particularly while Exchange Traded Funds (ETFs) have performed sub-optimally. Automated trading services are particularly alluring to clients, given the low-cost of operations, and the higher rates of return compared to traditional investment services. The countries with the greatest adoption of robo advisory services (2019 figures) include the following:

#5 – Canada – USD 5448 million

#4 – Germany – USD 8460 million

#3 – United Kingdom – USD 14,803 million

#2 – China – USD 179,442 million

#1 – USA – USD 749,703 million

While the efficacy of robo advisors has yet to be tested in a recessionary-style environment, the rapid adoption of such technology is certainly changing the way that people manage their portfolios. Naturally, the #1 reason why traders turn to robo advisors are the fees associated with these professional investment services. For example, Questwealth robo advisor by broker Questrade sports a low fee of just 0.25% for accounts valued at $1,000 – $99,999. For accounts valued at $100,000 +, the fee is reduced to just 0.20%. These fees do not include the MER of the Exchange Traded Funds, which can range between 0.17% through 0.22% for regular accounts, and if you have an RSI (socially responsible investing account), fees range between 0.21% through 0.35%.

The merit of these robo advisors is that the listed fees account for all the fees to be paid. There are no hidden charges. While certain types of portfolios fall under the broad umbrella of ‘robo advisors’ many of them are actually hybrid systems. With this particular system, there are teams of experts monitoring investments. This is similar to actively-managed accounts which are typically associated with higher fees. However, with the robo advisory service offered by Questwealth Portfolios as a case in point, the fees are low, negating the impact together. Other benefits include transfer fee coverage, and complimentary tax-loss harvesting. Extra value-added features include reinvested dividends and automatic rebalancing of financial portfolios, when required. Viewed in perspective, there is plenty of merit in selecting algo investment options over traditional investment options for the modern-day trader.

SU

SU REDDIT

REDDIT