SNAP: Truth or Fiction

Posted by : Premraj

| Posted on : Wednesday, November 20, 2013

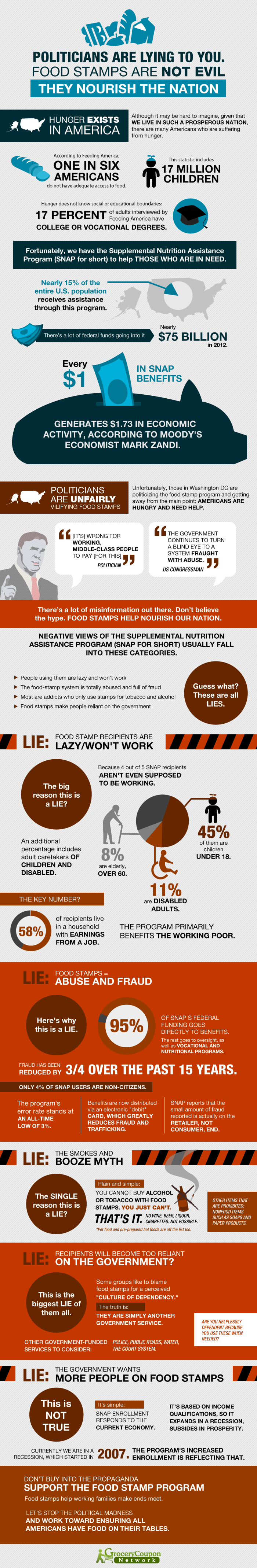

The government’s Supplement Nutrition Assistance Program, or SNAP, helps nearly 15% of the entire U.S. population gain adequate access to food. Additionally, 76% of SNAP households include a child, or elderly person. The fact of the matter is when we’re talking about food stamps, and SNAP we are talking about families. With the recent recession, enrollment has continued to increase. As the number of unemployed people increased by 94% from 2007 to 2011, SNAP enrollment increased by 70% during the same period.

Receiving help from the government in the form of SNAP, and food stamps may not be ideal, but for many it can prove to be the temporary aid they need to get back on their feet. As the effects from the recession start to improve, the enrollment in SNAP should also decrease; as these figures are historically linked. It’s also been noted that for every $1 in SNAP benefits, $1.83 is generated in economic activity, per Moody’s Economist Mark Zandi.

There are a lot of common misconceptions surrounding food stamps, and SNAP, but the truth is that without it many children would be without food, about 17 million children in America curently don’t have adequate access to food. To find out a little more about SNAP, please keep reading below. The infographic, by Grocery Coupon Network offers a lot of great information on SNAP, food stamps, some common misconceptions, and who is really benefiting from the program.

Comments : Post a Comment |

Category : Uncategorized |

Tags :

The need for money is an unending one. Imbalance in economic conditions combined with a need for safety and comfort nudges one to have a second job since the plushiest jobs which also being the most coveted ones seldom might live up to their promises. With the populations soaring and funds plummeting, it is but […]

Read More >>

You may hate the word “budget.” But rather than viewing budgets as restrictive, think of them as a way to gain better control over your finances. A budget is basically a plan that outlines how you’ll spend your money on a weekly or monthly basis. Take how much you earn, calculate your expenses and develop […]

Read More >>

Most home budgets include the big stuff: rent/mortgage, food, utilities, etc. However, going a bit further and breaking down some of those line items can give you a better picture of exactly how you’re spending your money. Here are a few budget line items that most budgets don’t have, but should: Work expenses Whether you […]

Read More >>

Budgeting is a concept that every student grows to be familiar with and especially now with so many students relying on financial aid to help pay for their education. As college costs continue to rise year after year many students must not only work as a full-time student but often take on part-time jobs to […]

Read More >>

Anyone who’s ever looked into iPhone (or really any Apple product) accessories have realized at least one thing – they’re all so expensive! After receiving my first iPhone I was so excited to look into all the bells and whistles of accessories that are offered, which is when I realized just how expensive they were. […]

Read More >>

Being in complete control of your money doesn’t require a degree in finance, nor do you have to work alongside personal finance experts. But since personal finance isn’t taught in schools, and because some parents don’t teach their kids how to manage money, many adults learn good financial skills by trial and error. There are […]

Read More >>

Financial experts recommend at least a three to six month cash reserve. This creates a nice safety net if you’re ever laid off from work or experience another emergency. If you have less than this amount in the bank, you’ve got some work to do. Understandably, growing your savings account isn’t always easy. Different factors […]

Read More >>

A home is a big investment for the future but the cost of living, at this moment, can cause a tremendous amount of stress if it’s breaking the bank. The good news is that there are plenty of ways to reduce, minimize, and cut-back on your way of living without making huge sacrifices to your […]

Read More >>

As the price of vacationing increases and the summer heat begins to seep into you, taking a last minute getaway may sound like an attractive prospect. However, your checkbook may not agree with you unless you’re a savvy shopper and does a little preparation before you decide to jet off on your vacation. Sign up […]

Read More >>

Most people have financial concerns especially during an economic downturn. To help out we have compiled 5 of the most common finance questions and answers: 1. What steps can I take when I first start saving? Answer: One of the first steps might be to put together a budget. You’ll need to know how much disposable […]

Read More >>

SU

SU REDDIT

REDDIT